With oil prices enjoying a powerful renaissance in recent months amid mounting supply concerns, declining inventory and the growing possibility that China’s economy may finally kickstart, energy giants such as Exxon and Chevron had enjoyed a similar rebound in their stock price, and in fact XOM hit a record high as recently as 2 weeks ago. Which is why many were looking to today’s earnings reports by the largest US energy company to see if the numbers would validate the rebound in sentiment and, of course, price.

So here is what Exxon reported today for the first quarter:

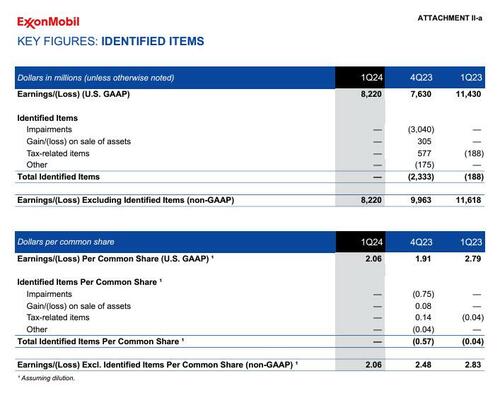

- EPS of $2.06, down from 2.83 a year ago, and missing consensus estimates of $2.19, as a result of delayed bump in commodity prices (which however will lift results in Q2) and a spike in non-cash charges

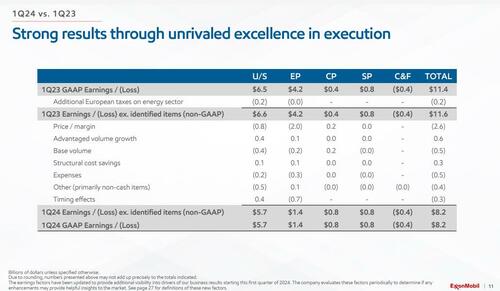

The Net Income number was $8.22 billion, down from $11.618 billion a year ago, with weakness in Upstream and Energy products hitting the bottom line number, coupled with an increases in expenses. The biggest factor behind the drop in earnings was a $2.6 billion hit to price/margin due to lower energy prices in Q1. However, with Brent now well above year ago levels and rising, what XOM lost in Q1 it will more than make up in Q2 absent a collapse in the energy market.

A breakdown by the various operating segments, reveals that price and margin were indeed the biggest culprits for declining earnings.

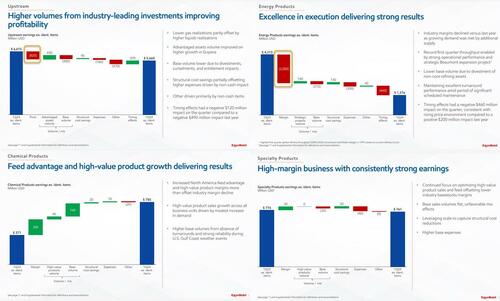

Taking a closer look at the company’s two main divisions, Upstream and Energy products, the company provided the following detail for the somewhat disappointing earnings here, starting with Upstream:

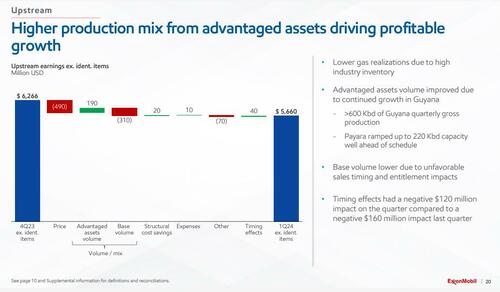

- Lower gas realizations due to high industry inventory

- Advantaged assets volume improved due to continued growth in Guyana

- >600 Kbd of Guyana quarterly gross production

- Payara ramped up to 220 Kbd capacity well ahead of schedule

- Base volume lower due to unfavorable sales timing and entitlement impacts

- Timing effects had a negative $120 million impact on the quarter compared to a negative $160 million impact last quarter

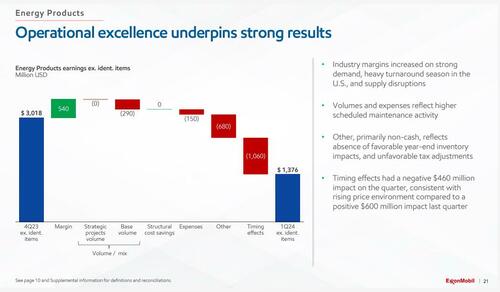

Energy products, where we saw the bulk of the earnings delta (some $1.7BN in earnings reductions between Q4 and Q1), was more interesting as Exxon attributed the slide to three primary drivers:

- Volumes and expenses reflect higher scheduled maintenance activity

- Non-cash charges which reflected the absence of favorable year-end inventory impacts, and unfavorable tax adjustments

- Finally, timing effects which had a negative $460 million impact on the quarter, consistent with rising price environment compared to a positive $600 million impact last quarter (this is derivative trades which are completely separate from the core business)

“Any given quarter we’ll have a number of non-cash, just a bit more unusual expenses that kind of ebb and flow,” CFO Kathy Mikells told BBG in an interview. “This quarter we had a number of small ones that added up together to be more significant and that’s difficult for analysts to model.”

“We continue to bring projects in more quickly and under budget so we’ve just had great execution in Guyana,” Mikells said, noting that gross daily production is now more than 600,000 barrels, up from 440,000 in the final three months of 2023.

Exxon’s accounting charges were non-cash items associated with tax and inventory balance sheet adjustments, Mikells said. The company also had higher expenses from scheduled maintenance at its facilities.

Some more highlights from the report:

- Exxon started output at Payara, its third Guyanese development, ahead of schedule late last year, adding 220,000 barrels of daily supplies that earn profits even if crude plunges to the $35 mark.

- Achieved quarterly gross production of more than 600,000 oil-equivalent barrels per day in Guyana and reached a final investment decision on the sixth major development.

- Net production was 47,000 oil-equivalent barrels per day lower than the same quarter last year with the growth in advantaged Guyana volumes more than offsetting the earnings impact from lower base volumes due to divestments, government-mandated curtailments and unfavorable entitlement effects.

- Excluding the impacts from divestments, entitlements, and government-mandated curtailments, net production grew 77,000 oil-equivalent barrels per day driven by the start-up of the Payara development in Guyana.

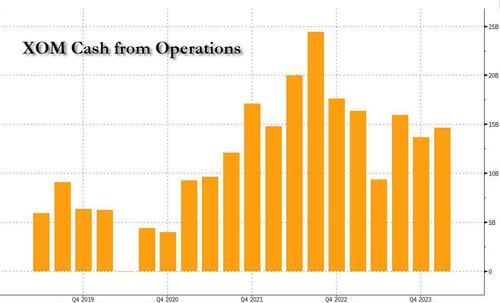

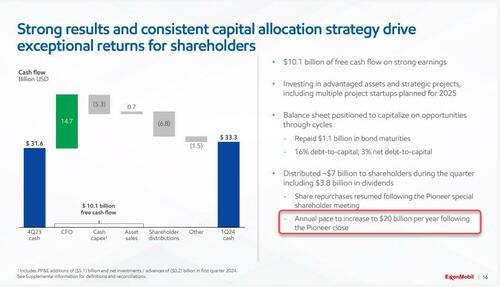

What is remarkable is that even though earnings missed mostly on the timing effect of commodity price increases and one-time charges, which has sent the stock tumbling this morning, the company still managed to blow away expectations for cash generation: in Q1, cash from operations jumped to $14.7 billion, $1 billion higher than Q4 2023 and also $1 billion higher than forecasts, boosted by the more than 35% uplift in Guyanese crude production.

This in turn led to a $1.8 billion increase in the company’s cash balance despite $6.8 billion in shareholders distributions including $3.8 billion in dividends.

Exxon’s capital spending was $5.8 billion in the first quarter, a third lower than the previous three month period when the company incurred some added Guyana costs. If that level of spending is repeated for the rest of the year, annual capital expenditure would come in at the low end of the company’s $23 billion to $25 billion guidance, and in a market where capital efficiency is extremely rewarded, it likely means that new all time highs are just weeks if not days away.

More importantly, XOM says that it is on pace to increase buybacks to $20 billion following the close of the Pioneer acquisition, some time in Q2.

Exxon’s stellar performance in Guyana explains why arch-rival Chevron wants to get into the project via a $53 billion takeover of Hess, which has a 30% stake. Exxon claims it has a right-of-first refusal over Hess’s stake while Chevron says that doesn’t apply because its deal is a corporate merger.

Arbitration is still in its “very early days,” Mikells said. Each side has chosen one arbitrator who will sit on a panel of three, she said. Hess this week extended the closing date of its deal with Chevron by six months to October.

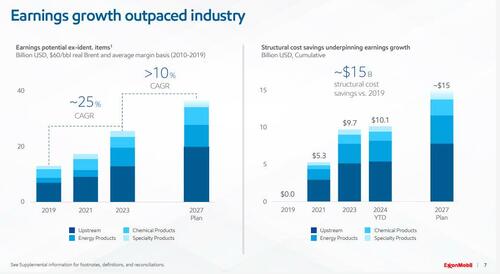

Finally looking ahead, the company forecast that it is on track to more than double upstream profits by 2027…

… and with cost-savings expected to save another $5BN in spending by 2027 (a total of $15BN vs 2019), this translates into a stellar 10% CAGR in bottom line earnings, and about $10BN in incremental earnings potential by 2027.

Commenting on the results, Goldman said that relative to its forecasts, US E&P and International R&M drove the miss. Worldwide production came in at 3,784 MBOE/d vs GS at 3,776 MBOE/d and FactSet consensus at 3,808 MBOE/d, with stronger US and International liquids partially offset by weaker US and International gas production.

More importantly, the Goldman analyst writes that, as noted above, timing effects from unsettled derivative mark-to-market impacts and other primarily non-cash impacts from tax and inventory adjustments contributed to the miss vs GS estimates. Additionally, the company reiterated Structural Cost Savings target of $15bn by 2027, with total savings reported at $10.1 bn vs 2019 levels.

So in its infinite wisdom, when faced with a company that is generating more cash than 99% of companies – and is not reliant on hype and chatbots to keep growing but good, old-fashioned energy which may be boring but is what keeps the world turning – this morning the algos decided to dump their Exxon shares sending the stock some 4% lower, and allowing anyone who pays attention to load up on the dip.

The XOM Q1 investor presentation is below (pdf link)

Tyler Durden

Fri, 04/26/2024 – 11:45