Readers are well aware that the office segment of the commercial real estate sector has been in turmoil for the past year with soaring vacancy rates, a record amount of available sublease space, and rising defaults.

Cost-cutting strategies by major corporations will accelerate the office downturn. This will be in the form of lease expirations and/or the early termination of leases.

A leaked document by Business Insider reveals that Amazon is trying to save $1.3 billion over the next three to five years. A person familiar with the new strategy said the company plans to “let certain leases naturally expire, stop the use of some office floors, and negotiate early lease terminations for some buildings.”

The person said Amazon’s current office vacancy rate is 33.8% but expects it to drop to 25% by the end of the year and decrease to 10% over the next three to five years. According to the document, this move to shrink Amazon’s corporate footprint will save the company $1.3 billion in annual operating expense savings.

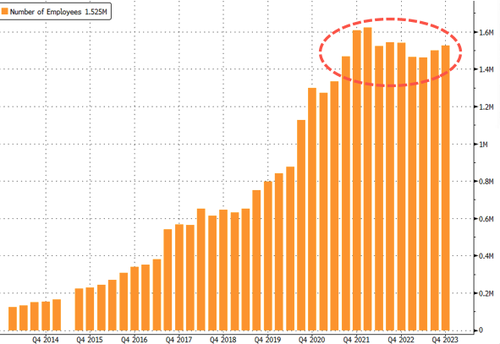

On Tuesday, BI reported that Amazon initiated another round of layoffs, this time 160 employees from its advertising unit, extending its 18 months of job cuts. The current high office vacancy rate is a direct result of slower growth and continued layoffs.

Like Google, Meta, and many other big tech companies, Amazon overhired in the run-up to and during Covid. Now, the hiring cycle is reversing as artificial intelligence threatens white-collar jobs.

In an email to BI, Brad Glasser, an Amazon spokesperson, said:

“We’re constantly evaluating our real-estate portfolio based on the dynamic and diverse needs of Amazon’s businesses by looking at trends in how employees are using our offices.

“In some cases, employees may move buildings to increase collaboration and drive better utilization of our workspaces. In other cases, we may take on additional space where we’re currently limited or make adjustments where we have excess capacity. The changes we’ve already made are improving vacancy rates, and we expect to see further progress as we continue to learn and iterate on our portfolio.”

Amazon is one of many companies that have been shrinking its corporate footprint. Many other big tech firms have been slashing square footage as office space floods the market, pressuring tower values lower and leaving owners with a difficult decision to either refinance (if they can) or default.

The rating agency Fitch recently warned that the sliding tower value could exceed GFC’s real estate crisis, as the bottom has yet to be found.

One week ago, Goldman told clients that office commercial mortgage-backed securities were being extended and modified rather than refinanced, which has “helped mitigate a default wave and a sharp pick-up in losses on CRE loan portfolios.” But this only means the can is being kicked down the road until after the presidential elections.

Tyler Durden

Thu, 03/28/2024 – 07:45